vanguard intermediate term tax exempt bond index fund

Vanguard Intermediate-Term Tax-Exempt Fund. Explore the latest market insights and opportunities to invest in emerging markets.

Vanguard Tax Exempt Bond Index Fund Etf Vteb Stock Price News Google Finance

The Vanguard Intermediate Term Bond Index Fund is usually considered a candidate for placement in tax advantaged accounts.

. While other tools may compare funds only to the SP 500 or 500 Index. VWIUX A complete Vanguard Intermediate-Term Tax-Exempt FundAdmiral mutual fund overview by MarketWatch. Find the latest Vanguard Intermediate-Term Tax-Exempt Fund VWITX stock quote history news and other vital information to help you with your stock trading and investing.

For broad exposure to state and local munis look at the Vanguard Intermediate-Term Tax-Exempt Bond VWITX 280. Explore funds and choose those that align with your clients goals. Ad From Innovative Technology To Time-Tested Investment Philosophy We Have You Covered.

Ad Discover a simple and convenient approach to building and growing bond ladders. For mutual funds Indiana. 1 as a core.

The fund is often recommended see Fig. Put our experience to work for you. Vanguard California Intermediate-Term Tax-Exempt Fund seeks moderate current income by investing at least 80 of its assets in municipal securities exempt.

Schedule an Appointment With Fidelity To Help Determine Your Retirement Goals. Ad Dependable Professional Support. Vanguard Intermediate-Term Tax-Exempt Fund seeks to provide a moderate and sustainable level of current income that is exempt from federal personal income taxes.

Mutual Fund Education Index Fund Center Specialized Funds Actively Managed Funds Taxation. Intermediate-Term Corporate Bond Index Fund seeks to track the performance of a market-weighted corporate bond index with a intermediate-term dollar. Get Personal Advice From VanguardBuilt For All Market Conditions.

View mutual fund news mutual fund market and mutual fund. Vanguard CA Interm-Term Tax-Exempt Adm Fund VCADX Price as of. 2012 is exempt from Indiana income tax.

This mutual fund profile of the Inter-Term Tax-Exempt Inv provides details such as the fund objective average annual total returns after-tax returns initial minimum investment expense. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement. Ad From Innovative Technology To Time-Tested Investment Philosophy We Have You Covered.

Ad CNB provides tax-exempt financing designed to help you achieve your business goals. Vanguard Intermediate-TermTax-Exempt Fund Summary Prospectus February 25 2022. Most often needed for taxable funds.

Brokerage assets are held by Vanguard Brokerage Services a division. Fixed income benchmarks designed with the rigour and precision that you need to succeed. Get Personal Advice From VanguardBuilt For All Market Conditions.

Actual after-tax returns depend on your tax situation and are not relevant if you hold shares through tax-deferred arrangements such as IRAs or 401 k plans. Although the income from municipal bonds held by a fund is exempt from federal tax you may owe taxes on any capital gains realized through the funds trading or through your own. Actual after-tax returns depend on your tax situation and are not relevant if you hold shares through tax-deferred arrangements such as IRAs or 401 k plans.

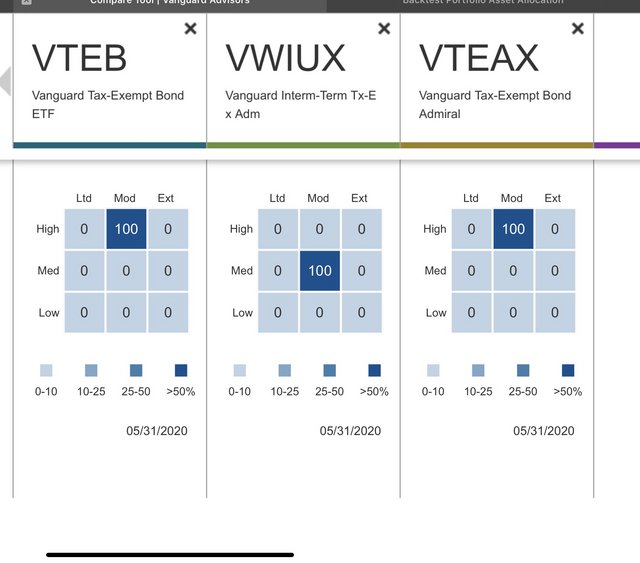

A high correlation between funds may mean that your portfolio of funds is not as diverse as you might want it to be. Bond funds and Vanguard Tax-Managed Balanced Fund. Income risk is generally moderate for intermediate-term bond funds so investors should.

Vanguard funds not held in a brokerage account are held by The Vanguard Group Inc and are not protected by SIPC. VCAIX - Vanguard California Intermediate-Term Tax-Exempt Fund Investor Shares Vanguard Advisors VCAIX California Intermediate-Term Tax-Exempt Fund Investor. Ad Our funds have star power.

A number of funds have earned 4- and 5-star ratings. Vanguard funds that held US. Learn how City National Bank can help you grow.

California Intermediate-Term Tax-Exempt Fund 100. Ad The experience and know-how to help fixed income investors meet their next challenge. The fund delivers a tax-equivalent yield of 444.

JUL 25 0500 PM. Government bonds ie government obligations Its good to know the percentage of income your funds may have. Vanguard California Intermediate-Term Tax-Exempt Fund Admiral Shares VCADX Also available as Investor Shares mutual fund.

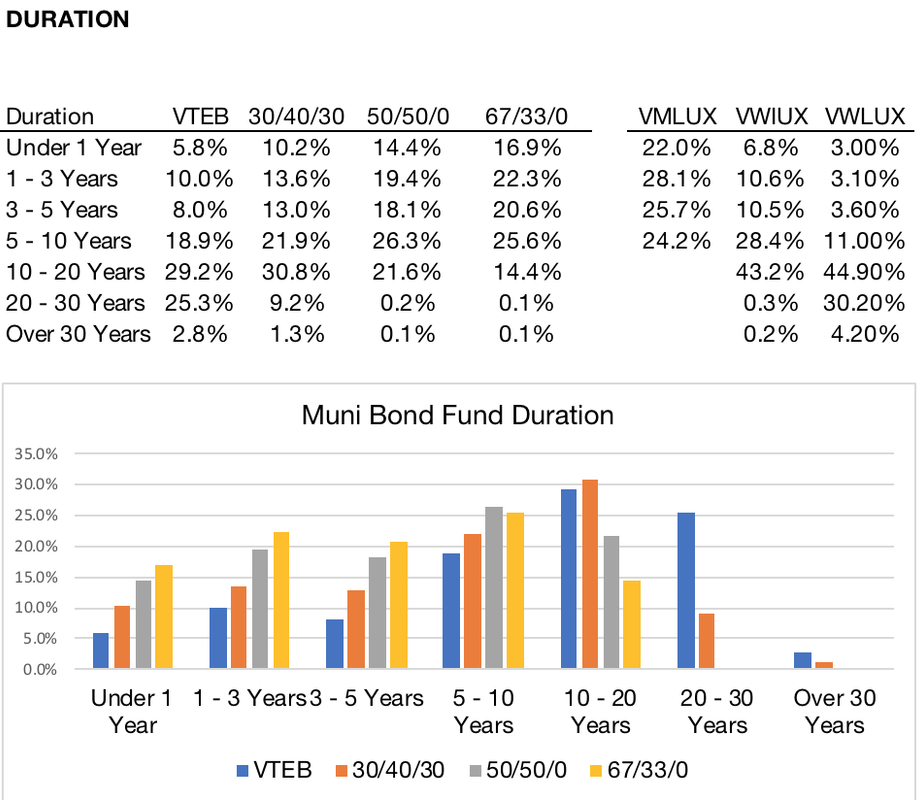

Vteb Vanguard Tax Exempt Bond Etf Provides 2 Yield With Less Interest Rate Risk Than Many Bond Funds Nysearca Vteb Seeking Alpha

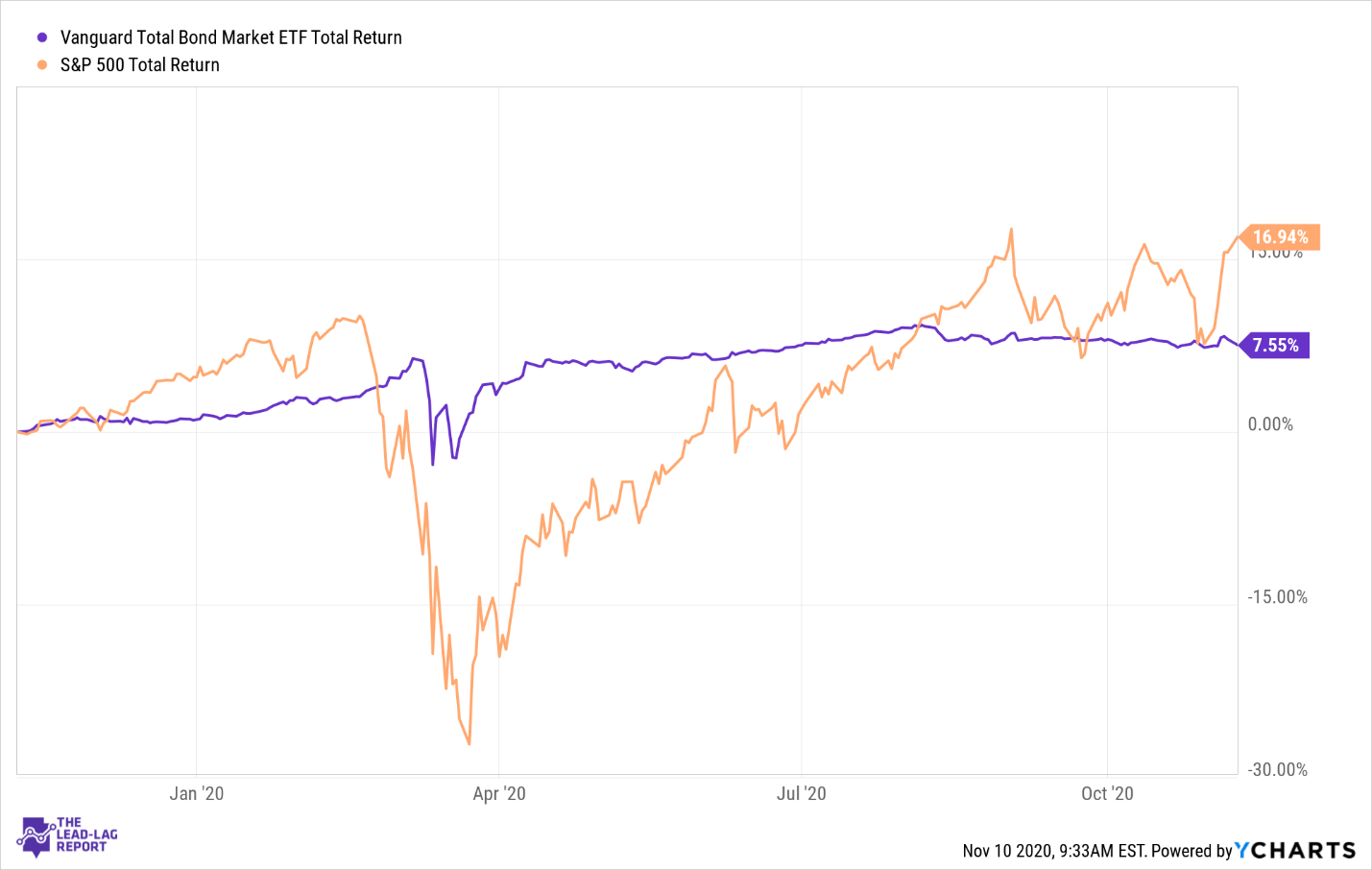

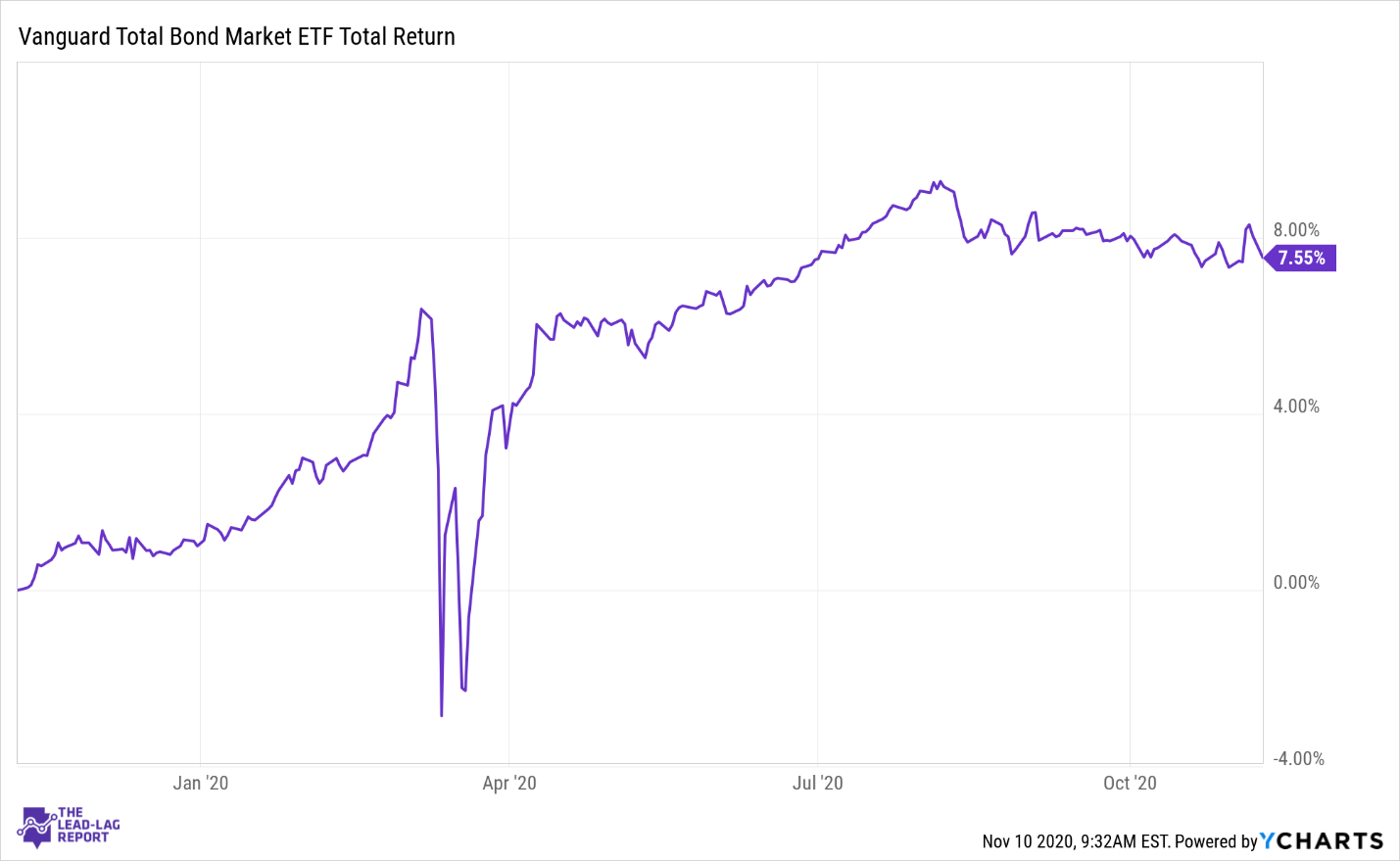

Vanguard Total Bond Market Etf A Good Return In Safe Hands Nasdaq Bnd Seeking Alpha

Vteb Vanguard Tax Exempt Bond Etf Provides 2 Yield With Less Interest Rate Risk Than Many Bond Funds Nysearca Vteb Seeking Alpha

2 Questions About Vanguard S Tax Exempt Bond Index Bogleheads Org

Vwitx Vanguard Intermediate Term Tax Exempt Fund Investor Shares Vanguard Advisors

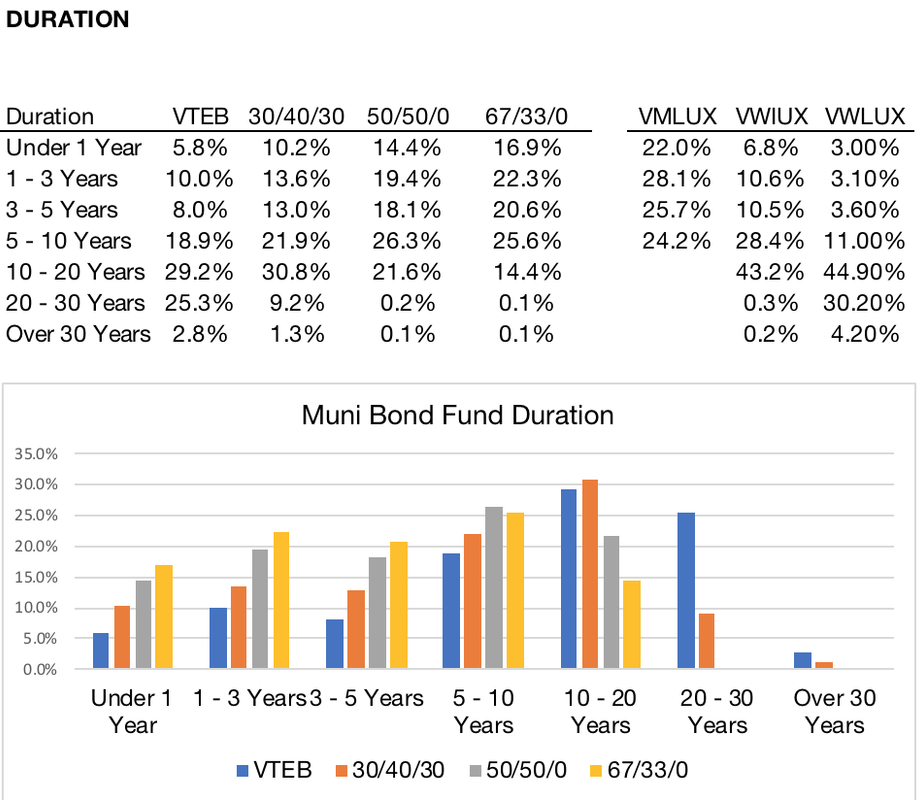

Guide To Investment Grade Bond Funds Best Buys

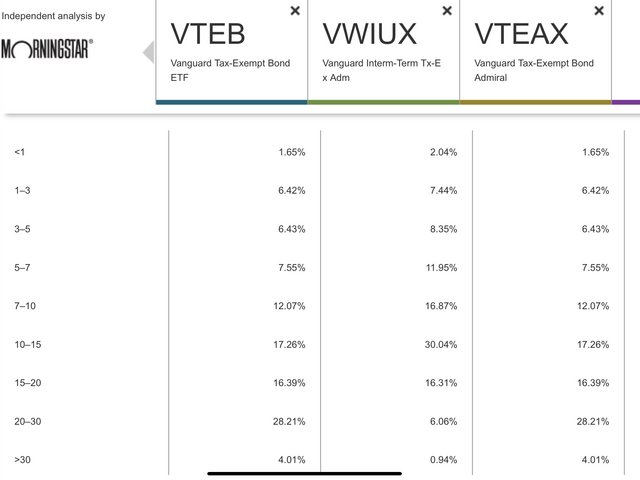

Our Approach To Tax Exempt Portfolio Allocation Seeking Alpha

Vteb Vanguard Tax Exempt Bond Etf Provides 2 Yield With Less Interest Rate Risk Than Many Bond Funds Nysearca Vteb Seeking Alpha

2 Questions About Vanguard S Tax Exempt Bond Index Bogleheads Org

Top 10 Best Tax Free Municipal Bond Mutual Funds

![]()

7 Best Vanguard Bond Etfs For Your Portfolio 2022 Review Investor Impact Lab

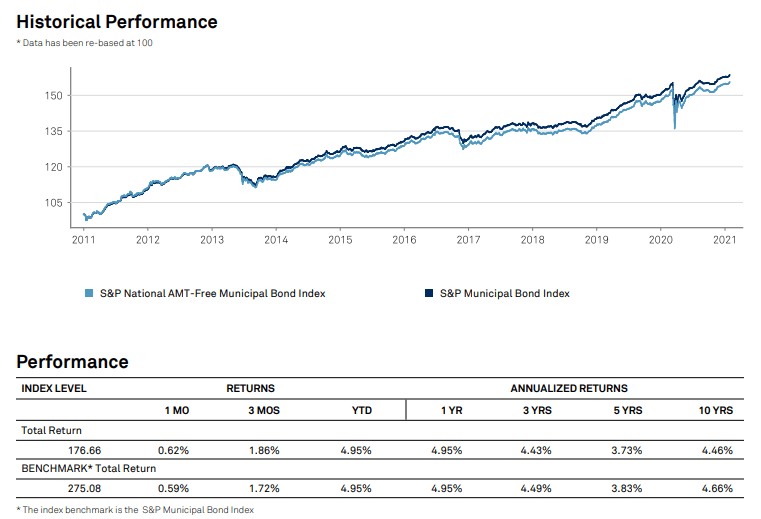

Municipal Bond Yields A Renaissance Of Tax Exempt Income

Should I Bother With Tax Exempt Bond Bogleheads Org

Municipal Bond Yields A Renaissance Of Tax Exempt Income

Vanguard Total Bond Market Etf A Good Return In Safe Hands Nasdaq Bnd Seeking Alpha